Millions of low- to moderate-income workers and families claiming the Earned Income Tax Credit (EITC) face a built-in delay on their tax refunds during the 2026 filing season. This holdup stems directly from federal law designed to curb fraud, meaning even early filers who submit perfect returns often cannot see money hit their accounts before late February or early March. Understanding the rules and timeline helps set realistic expectations and avoid frustration during tax season.

The Legal Reason Behind the Delay

The Protecting Americans from Tax Hikes (PATH) Act of 2015 established strict protections for refundable credits like the EITC and the Additional Child Tax Credit (ACTC). By law, the IRS cannot issue these refunds before mid-February—even if the return is accepted early and everything checks out. The restriction applies to the entire refund when EITC or ACTC is claimed, not just the credit portion. This mandatory waiting period allows extra time for the IRS to run fraud-prevention reviews, verify income and eligibility, and cross-check information against employer and government records.

2026 Filing Season Key Dates

The IRS kicked off the 2026 tax season on January 26, accepting and processing 2025 returns starting that day. Taxpayers have until April 15, 2026, to file and pay any owed taxes. For most non-EITC filers, refunds with direct deposit can arrive within 21 days of acceptance. EITC and ACTC claims follow a different schedule due to the PATH Act rules.

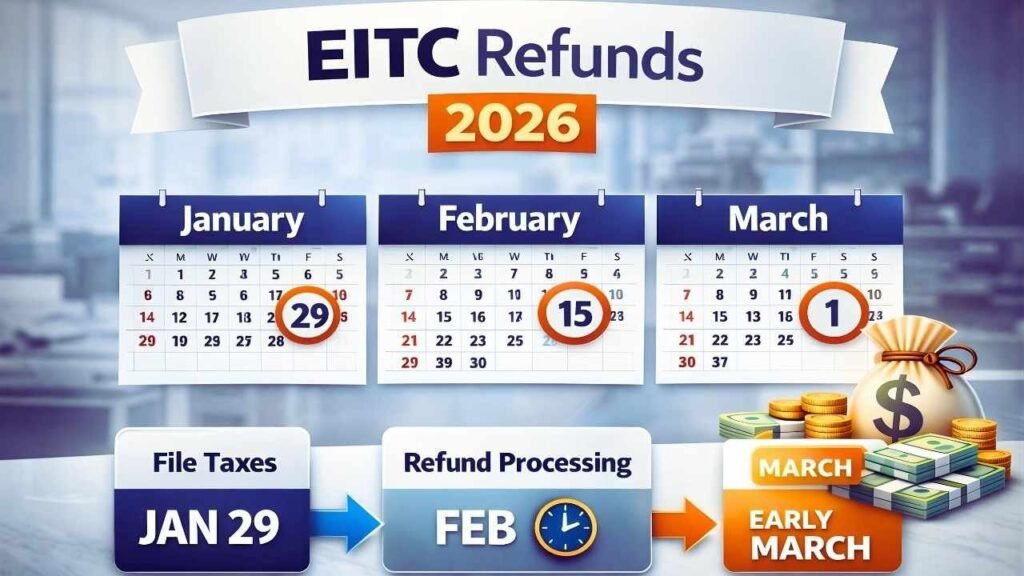

Here are the main timeline milestones for 2026:

- January 26: Filing season opens; early e-filers submit returns

- Mid-February (around February 15–16): IRS begins processing and releasing EITC/ACTC refunds

- Late February (around February 21–27): Where’s My Refund tool updates with projected dates for most early filers

- Early to mid-March (often by March 3–6): Majority of qualifying refunds hit bank accounts via direct deposit

Paper check recipients typically wait a bit longer, adding 1–2 weeks for mailing.

How the Refund Process Works for EITC Claimants

Once a return is e-filed and accepted, the IRS runs mandatory reviews for EITC-related claims. These checks help catch identity theft, incorrect income reporting, or ineligible claims before funds go out. If everything clears, the agency schedules the deposit. The Where’s My Refund tool on IRS.gov provides the most accurate personalized status—often showing “Refund Sent” or a direct deposit date once processed. Tax software providers like TurboTax also note that projected dates for early EITC filers usually appear by late February.

What This Means for Millions of Families

The delay affects a large group—roughly one in five tax filers claims the EITC, many of them working parents or individuals with modest earnings. While the wait feels long, especially for those counting on the money for bills or essentials, the rule has successfully reduced fraudulent refunds since its implementation. Non-EITC portions of a refund (from withholdings or other credits) do not face the same holdup if separated, but most people claiming EITC see their full amount tied to the mid-February release.

Tips to Speed Things Up and Avoid Surprises

File electronically with direct deposit for the fastest possible processing. Double-check all information for accuracy to prevent holds from errors or mismatches. Use the IRS Free File or reputable software to submit early. Track progress weekly through the official Where’s My Refund tool rather than relying on rumors or third-party estimates. If issues arise, the IRS may request additional documentation, which can extend timelines further.

The EITC remains one of the most effective anti-poverty tools available, often delivering substantial refunds that boost household finances. While the March arrival frustrates many, it reflects deliberate safeguards that protect the program and taxpayers. Staying patient and informed makes the process smoother for everyone involved.

FAQs

Why can’t EITC refunds arrive before mid-February?

Federal law under the PATH Act prohibits the IRS from issuing EITC or ACTC refunds before mid-February to allow time for anti-fraud reviews and verification.

When will most EITC refunds arrive in 2026?

The majority should hit bank accounts by early March, with many seeing funds between late February and March 3–6 if filed early with direct deposit.

Does the delay apply only to the EITC amount?

No, the entire refund is held if you claim EITC or ACTC, even if other credits or withholdings make up part of it.

How can I check my EITC refund status?

Use the IRS Where’s My Refund tool on IRS.gov or the IRS2Go app; it updates with specific deposit dates for most filers by late February.

What if my refund is delayed beyond March?

Contact the IRS if no update appears by mid-March, or check for notices requesting more information—common issues include mismatches or identity verification needs.